Ways to Give

“We make a living by what we get, but we make a life by what we give.” — Winston Churchill

Did You Know...

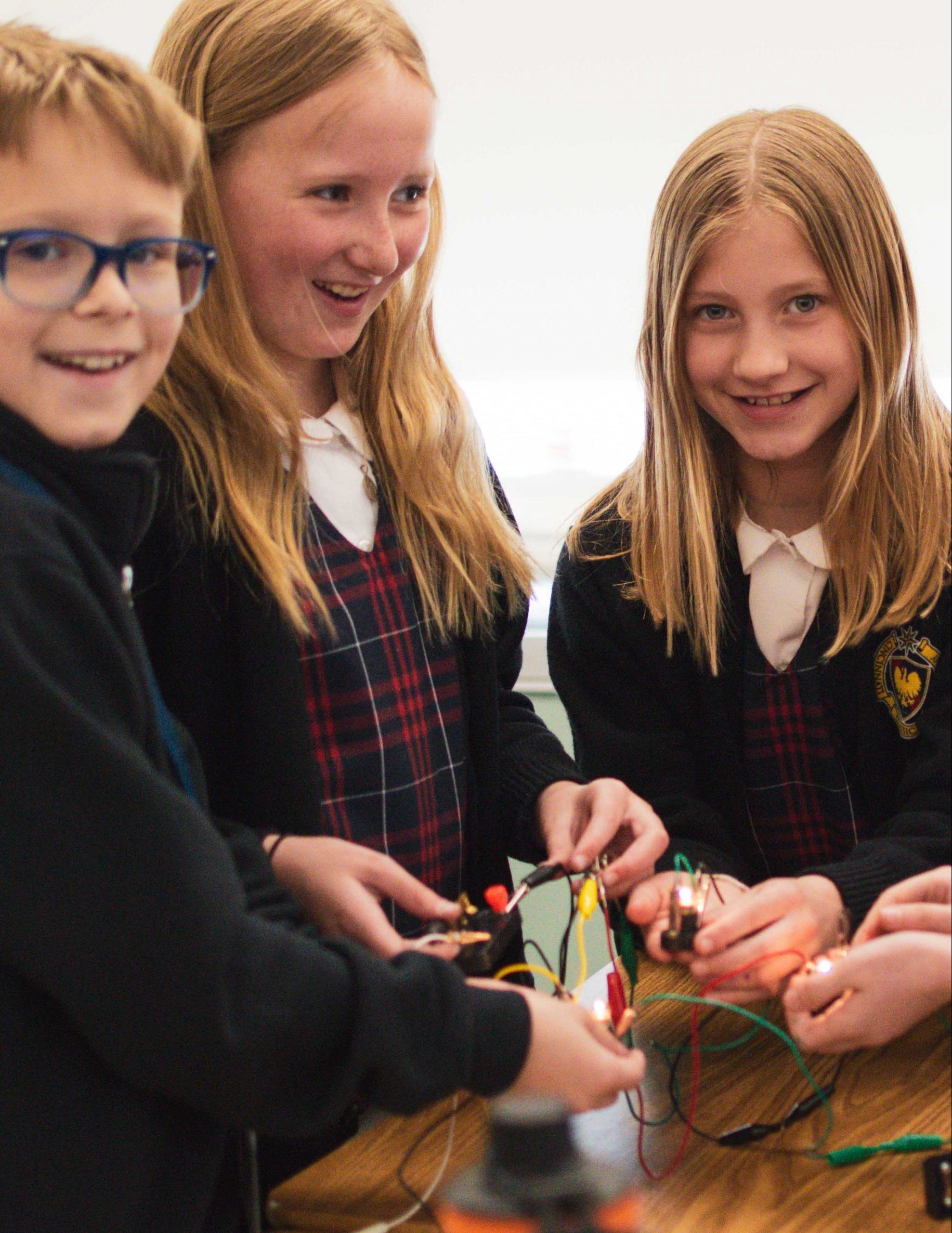

in our first year, Cincinnati Classical Academy students:

- Joyfully recited over 100 poems and historical texts in one school year

- Delved into algebraic concepts using Singapore Math

- 30% of our 6th graders placed in the regional science fair; 31% of them went to State

- Won chess tournaments, national writing competitions, and the Tristate Scripps Spelling Bee

- Scored #1 (of 259) of all public community schools in the State of Ohio in Early Literacy

- Scored #1 (of 21) of all public community schools in Hamilton County in overall academic achievement

- Scored #4 (of 120) of all public schools (district or community) in Hamilton County in Early Literacy

- Won three banner championships in girls volleyball

These are a few successes achieved with less funding than traditional public school districts receive. We do more with less. As a public community school, Cincy Classical receives no additional funding beyond the base rate as traditional public schools do. We must cover capital and other program and indirect and program costs independently.

Ways to Give:

One Time or Recurring

Secure donations made electronically by credit/debit card or by check payable to Cincinnati Classical Academy. Mail to: Cincinnati Classical Academy. 170 Siebenthaler Ave. Cincinnati, OH 45215.

Pledges

A gift amount committed over a specified amount of time: monthly, quarterly or annually within a set time frame. All annual pledges must be paid by the end of each fiscal year, which is June 30th.

Matching Gifts

Most companies will match an employee’s gift to a charity one-to-one, while others may even match up to three-to-one! Check with your HR department to see if your company offers a matching gift.

Securities

Cincy Classical also holds a brokerage account for the donation of securities, such as stocks, bonds, mutual funds, and other investment holdings. Tax savings to the donor can be significant. Please contact Dr. Jed Hartings at jed@cincyclassical.org.

IRA Rollovers

For traditional IRA accounts, individuals age 70½ and older may direct funds from an IRA to a qualified charitable institution for up to $100,000 without recognition of taxable income by the donor. Please contact Dr. Jed Hartings at jed@cincyclassical.org.

Sponsorships

Sponsorships of Sentinel events, activities and athletics are also available. All our programs are opportunities to build teamwork and community, and to practice perseverance and humility. Please contact Dr. Jed Hartings at

jed@cincyclassical.org.

Support the CLASSICAL Annual Fund!

Nota Bene: Cincinnati Classical Academy is incorporated as a non-profit entity in the State of Ohio and is recognized as a 501(c)(3) entity by the IRS (EIN 85-0609855). As such, your gift qualifies as a charitable deduction for tax purposes to the extent the law permits.